By LISA LERER

Associated Press

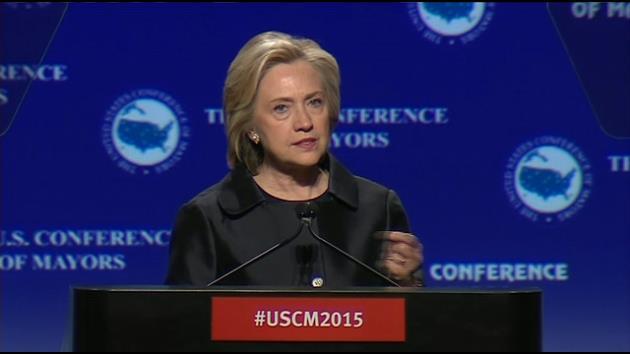

WASHINGTON (AP) – Hillary Rodham Clinton plans later this week to propose raising capital gains taxes for some investors, part of a larger campaign effort to encourage greater focus on longer-term economic growth rather than more immediate gains for investors.

The new rates would be pegged to the duration of the investment, with short-term holdings taxed at a higher percentage.

Earlier this year, President Barack Obama proposed raising the 23.8 percent capital gains rate to 28 percent for the highest earners. While Clinton's proposal is still being finalized, her rate would likely be higher than Obama's for the shortest-held investments, according to a campaign official who spoke anonymously to discuss plans still being developed. Currently, gains on securities held for more than a year are taxed at the same rate as those held for decades.

Clinton's proposal marks a shift from her 2008 campaign, when she promised not to raise capital gains rates higher than the 20 percent bracket established during her husband's administration. At the time, the rate was 15 percent – a result of the tax cuts championed by then-President George W. Bush.

"I wouldn't raise it above the 20 percent, if I raised it at all," Clinton said in an April 2008 debate.

Over his time in the White House, Obama has raised the rate 8.8 percentage points – fulfilling a campaign promise to increase capital gains taxes.

Many Democrats would like to see the rate go even higher, as part of a larger push by the party to crack down on what they see as Wall Street excess and tackle income inequality.

Last month, Neera Tanden, the head of the liberal Center for American Progress and a prominent Clinton adviser, proposed a "sliding-scale" capital gains tax that would drop the rate charged the longer the security is held.

"Once an investor holds a share past the one-year mark, the tax code provides no incentives to maintain the position any longer," Tanden wrote, in a report co-authored by investment banker Blair Effron, co-founder of Centerview Partners. "A more flexible capital gains tax system could be a tool to incentivize more prudent behavior in equities markets."

Clinton's plan is part of a larger package aimed at tackling what she argues is too heavy an emphasis on quick corporate gains at the expense of workers and broader economic growth. In an economic address last week, Clinton decried what she termed the problem of "quarterly capitalism," saying businesses are paying too little attention to research and development, improving factories and cultivating talent.

"Now it's easy to try to cut costs by holding down or decreasing pay and other investments to inflate quarterly stock prices, but I would argue that's bad for business in the long run," she said. "Workers are assets. Investing in them pays off. Higher wages pay off. And training pays off."

___

Follow Lisa Lerer on Twitter at: http://twitter.com/llerer

Copyright 2015 The Associated Press. All rights reserved. This material may not be published, broadcast, rewritten or redistributed.