By RONNIE GREENE

Associated Press

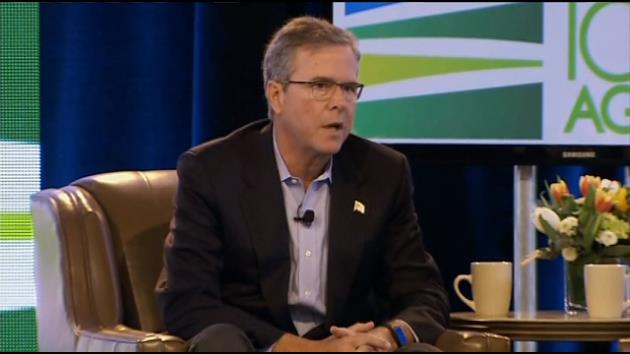

WASHINGTON (AP) — During his transition from Florida governor to likely presidential candidate, Jeb Bush served on the boards or as an adviser to at least 15 companies and nonprofits, a dizzying array of corporate connections that earned him millions of dollars and occasional headaches.

Bush returned to corporate America after leaving the governor’s mansion in early 2007, and his industry portfolio expanded steadily until he began shedding ties late last year to prepare a run for president.

Executives who worked alongside Bush describe him as an engaged adviser.

There is no formal rule limiting the number of boards on which one person can serve. But in the wake of the Enron scandal, common sense dictates a small number, experts said. “If somebody starts serving on more than three or four boards that’s a problem,” said law professor Elizabeth Nowicki, a former Securities and Exchange Commission lawyer.

Bush served on the boards or as an adviser to 11 companies or nonprofits at a time each year from 2010 to 2013, The Associated Press found. Those ties were in addition to his own businesses, such as Jeb Bush & Associates, and the educational foundations he created.

“Gov. Bush has always conducted his business with the highest integrity and performance, just as he did when he served as Florida’s chief executive for eight successful years,” said Bush spokeswoman Kristy Campbell.

She said not all the corporate entities were the same — some were board slots, some advisory positions and others nonprofits — and suggested it was unfair to put all in the same basket. AP’s review found that Bush served on the board of directors of as many as seven for-profit companies at a time — while also serving as an adviser to other companies and nonprofits.

Bush’s experience on corporate boards could evolve into a theme during the 2016 race for the presidency. Among the issues the Florida Republican could be asked to explain:

–One company that paid Bush $15,000 a month as a board member and consultant, InnoVida Holdings, collapsed in fraud and bankruptcy, with the company’s CEO, Claudio Osorio, now serving 12 1/2 years in prison. Bush joined InnoVida despite warning signs that Osorio’s prior company dissolved amid bankruptcy and allegations of fraud.

–At least five companies where Bush served on the board or as adviser faced class-action lawsuits from shareholders or legal action by the government.

–Bush earned $3.9 million from four companies alone since 2007, the AP found, plus $25,000 a year more from a medical company in Georgia, $9,600 annually from Bloomberg Philanthropies and zero pay from a drug addiction nonprofit. His earnings from eight other companies are unknown, and Bush has declined AP’s requests to disclose his compensation.

Bush returned to corporate America less wealthy than when he took office — with a net worth of $1.3 million, down from $2 million.

In 2007, he joined the board of Tenet Healthcare Corp., where he earned $2,375,870 in pay and stock through 2014. Bush challenged management to deliver for patients and consumers and attended 94 percent of board meetings, Tenet spokesman Donn Walker said.

Later in 2007, Bush accepted his most troublesome board position, joining Miami Beach’s InnoVida Holdings.

Bush conducted a thorough review before joining InnoVida’s board, Campbell said, including commissioning a background check of Osorio.

But financial red flags existed involving another company Osorio founded, CHS Electronics.

In 1999, just as Bush was beginning his first term as Florida governor, CHS investors filed suit in federal court in Miami accusing Osorio of inflating the company’s profits. The lawsuit cited an analyst who said, “There was fraud, and when I see fraud I walk away.”

CHS filed for bankruptcy protection in 2000, and, a year later, entered into an $11.5 million shareholder settlement. In September 2007, the SEC revoked CHS’ securities registration.

Three months later, Bush joined Osorio’s InnoVida, a manufacturer that said its unique fiber composite panel construction could withstand fires and hurricanes. But instead of building homes, including a U.S.-financed project in earthquake-stricken Haiti, Osorio used investors’ money to bankroll a lavish lifestyle.

One businessman who hired InnoVida as a contractor said that, when he visited Osorio at the company’s Miami Beach offices, Bush’s pictures were all over the wall.

“He drops his name repeatedly. `Jeb Bush this, Jeb Bush that.’ And you just say, OK, there’s credibility there,” said Troy Von Otnott, founder of Massive Technologies, a CleanTech consulting firm in Atlanta.

Now Von Otnott is among creditors trying to collect pennies on the dollar. “If you are running for the president of the United States of America, you need to show that you have judgment,” he said.

Once concerns about InnoVida arose, Bush “took action to address them immediately,” Campbell said.

Bush left InnoVida in September 2010 but continued serving on company boards.

One is CorMatrix Cardiovascular Inc., a Georgia-based medical device company where Bush served on the board from 2009-2014. “He was one of the most prepared board members that I have had the privilege of working with,” said Chief Financial Officer John Thomas.

Another is Rayonier Inc., a Florida publicly traded timber company that compensated Bush $977,320 from 2008-2014.

“He was an excellent board member,” said V. Larkin Martin, who also served on the Rayonier board. She said Bush actively responded when the company had to restate its financial statements in November 2014 and faced investor lawsuits.

Bush was an international advisory board member for the Barrick Gold Corp., the world’s largest gold mining company. The company said his pay is confidential.

——

Associated Press writer Steve Peoples contributed to this story.

Copyright 2015 The Associated Press. All rights reserved. This material may not be published, broadcast, rewritten or redistributed.