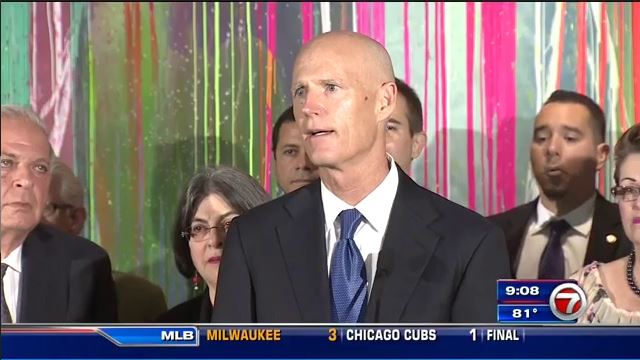

TALLAHASSEE, Fla. (AP) — A defiant Gov. Rick Scott embarked Tuesday on a collision course with state legislators by proposing a $83.5 billion budget that included a now-familiar menu of tax cuts, use of local tax dollars to boost school spending and money for incentives to lure businesses to Florida.

Scott, who released the details of his spending plan during the annual legislative planning session hosted by The Associated Press, framed his budget as a way to maintain the state’s economy and grow jobs.

“When jobs are created it helps the poorest, most disadvantaged families who need a job the most,” said Scott. “We cannot be shortsighted to think we are immune to another national recession.

Yet the Republican governor quickly encountered a buzz saw of opposition, primarily from House Speaker Richard Corcoran, who contended that some of the programs Scott wants to fund are wasteful and need to be eliminated. At one point, the Land O’ Lakes Republican even compared them to “cockroaches” that come out in the middle of the night.

Corcoran opposes the governor’s push for $85 million in business incentives and maintaining funding for the state’s tourism marketing agency. Visit Florida’s expenses have come under fire after it was revealed the agency spent $1 million on a contract with rap star Pitbull to promote the state.

Scott’s top priorities in his budget include a $618 million tax cut package that would sharply reduce sales taxes currently on charged on commercial leases. He also wants to offer residents several tax holidays where sales taxes would not be collected on items such as clothes or hurricane supplies.

But the governor is also counting on a rise in local property values to help boost public school funding. Scott’s proposed budget would increase day-to-day spending on schools by more than $800 million, or a 4 percent bump for each student. But more than half of that increase would rely on a rise in property values which means higher property tax bills for residents and business owners.

Scott has defended this approach saying that higher property values are a sign that the economy is improving.

But Corcoran flatly rejected Scott’s proposal, calling it a tax increase. He vowed to hold firm on that stance even if means legislators have to spend more time than usual to pass a state budget.

“I’ve said it a 1000 times, the House will not raise taxes,” said Corcoran. “And if that means a lengthy year we’re prepared for that.”

Scott’s budget recommendations come amid rising pressure on the state’s finances and a growing schism among House and Senate leaders on how to respond.

Scott, noting that Florida’s economy and its tax collections are growing, contended there’s plenty of money to pay for his spending plans. His budget also relies on deep cuts in hospital payments and the elimination of some state jobs, although Scott’s office said most of the targeted positions are vacant.

But Corcoran has called for at least $1 billion worth of cuts.

Senate President Joe Negron and Senate Republicans, meanwhile, are supporting an ambitious plan to purchase property south of Lake Okeechobee that requires borrowing. Negron has also said he wants to cut taxes by at least $300 million – but he would do so by eliminating a tax credit that’s being offered currently to insurance companies. Scott has not endorsed either idea.

In other key points Scott also recommends eliminating a contentious teacher bonus plan called the “Best and Brightest” that awards extra money to teachers based on their annual evaluations and their scores on the standardized tests used to get into college. The program had been pushed by House Republicans and Scott backed it last year.

In its place Scott wants to spend $58 million to help retain and recruit teachers. His plan includes offering hiring bonuses.

The governor didn’t include any across-the-board pay hikes for state workers, but he’s recommending pay raises for prison guards and other state law-enforcement officers such as highway troopers. He is also proposing performance bonuses for rank-and-file state employees.

Copyright 2024 The Associated Press. All rights reserved. This material may not be published, broadcast, rewritten or redistributed.